What Are Tariffs? Impact of Recent U.S. Tariffs on Global Trade

tariffs

global tariffs

EU zero for zero deal

WTO trade

A tariff is a tax imposed by a government on imported goods. Its primary purpose is to make foreign products more expensive, thereby encouraging consumers to buy domestic products. Tariffs are often used to protect local industries, balance trade deficits, and sometimes even as a political tool.

🏛️ Introduction: What is a Tariff?

A tariff is a tax imposed by a government on imported goods. Its primary purpose is to make foreign products more expensive, thereby encouraging consumers to buy domestic products. Tariffs are often used to protect local industries, balance trade deficits, and sometimes even as a political tool.

🌎 Why Do Countries Use Tariffs?

Governments use tariffs for several key reasons:

🛡️ Protect Domestic Industries: Tariffs make foreign goods more expensive, so consumers are more likely to buy locally-made products.

💰 Raise Government Revenue: Especially in developing countries, tariffs are a major source of income.

⚖️ Correct Trade Imbalances: If one country imports much more than it exports, it may impose tariffs to level the trade flow.

💼 Retaliate in Trade Disputes: Tariffs are often used as a weapon in trade wars to retaliate against other countries' trade policies.

🔐 Enhance National Security: Some tariffs aim to reduce dependence on other countries for critical goods (like energy, food, or medicine).

Tariffs are not just economic tools they often have political motives behind them, too.

🧾 Types of Tariffs

- Ad Valorem Tariff: A percentage of the value of the good (e.g., 10% on a $1,000 product = $100 tariff)

- Specific Tariff: A fixed fee per unit (e.g., $2 per liter of imported wine)

- Compound Tariff: Combines both ad valorem and specific tariffs (e.g., 5% + $1 per item).

📌 In Simple Words: A tariff is like a tax added to foreign goods to make them cost more, protect local jobs, or settle political arguments.

US Recent U.S. Tariffs: What Happened?

In recent years, the U.S. government has imposed tariffs on countries like China, Mexico, Canada, and EU nations — especially in sectors like steel, aluminum, electronics, and automotive parts.

Some key actions include:

- 2025 Tariffs on Chinese imports increased to 145%, citing national security concerns.

- 25% tariffs on all imports from Mexico and Canada, excluding Canadian oil and energy, which are taxed at 10%.

- 25% tariffs on steel and aluminum imports, affecting global supply chains.

China's Response to U.S. Tariffs

China has implemented several countermeasures in response to U.S. tariffs:

- Raised tariffs on U.S. goods from 84% to 125%, affecting various sectors.

- Imposed additional tariffs of 10-15% on U.S. energy products, including coal, LNG, and crude oil.

- Expanded export controls on critical minerals, such as tungsten, tellurium, bismuth, molybdenum, and indium.

- Launched antitrust investigations into U.S. companies, including Google.

- Filed complaints with the World Trade Organization (WTO), challenging the legality of U.S. tariff measures.

How Do Tariffs Impact Global Trade?

- Increased product costs: Tariffs raise the prices of imported goods, leading to higher costs for consumers and businesses.

- Disrupted supply chains: Companies may need to find alternative suppliers or relocate production to avoid tariffs.

- Trade tensions and retaliatory tariffs: Countries may impose their own tariffs, leading to a cycle of retaliation.

- Market volatility: Uncertainty surrounding trade policies can lead to fluctuations in financial markets

🌍 Global Impact and Other Countries' Reactions

The escalating trade tensions between the U.S. and China have had ripple effects worldwide:

- Canada and Mexico: Implemented retaliatory tariffs on U.S. goods in response to U.S. tariffs.

- European Union: Expressed concerns over the potential for a global trade war and is exploring measures to protect its industries.

- Developing Nations: Countries like India, Vietnam, and Bangladesh are navigating the shifting trade dynamics, with some benefiting from supply chain realignments.

Impact on U.S. Consumers and Businesses

- Higher prices for imported goods

- Increased costs for manufacturers who rely on global supply chains

- Reduced exports due to retaliation

- Uncertainty for investors and markets

Economic & Political Perspective

Tariffs can help protect industries temporarily, but long-term protectionism often leads to inefficiency, reduced competition, and economic friction.

Global tariff wars in 2025

global tariff wars in 2025 countries

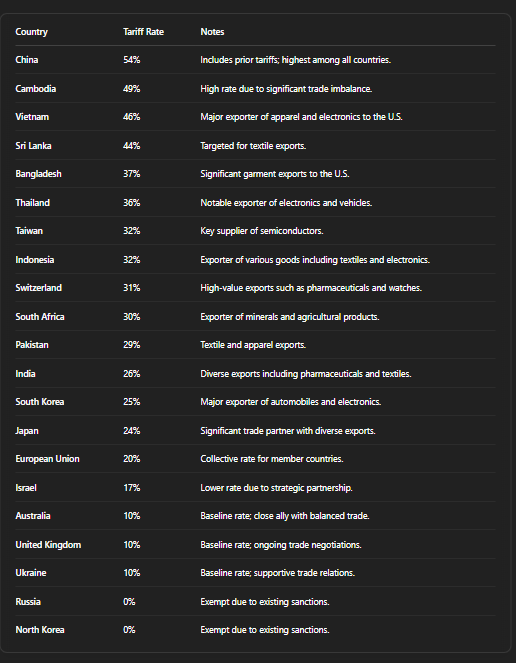

U.S. Tariff Overview (as of April 2025)

- Universal Import Tariff: 10% on all imports (effective April 5, 2025)Wikipedia

- Higher Country-Specific Tariffs: Applied to approximately 60 countries based on trade deficits and perceived unfair practices (effective April 9, 2025)Wikipedia+1Wikipedia+1

- China: 54% effective tariff rate after combining new and existing levies

Recent U.S. tariffs on other countries

tariff list about US

Note: Tariffs on steel, aluminum, vehicles, and vehicle parts remain unchanged from previous measures. Energy products and certain minerals not available in the U.S. are exempted.Wikipedia

How Tariff Wars Are Shaping Global Supply Chains

Tariffs do not only affect the countries directly involved—they ripple across global supply chains, forcing companies to rethink manufacturing, logistics, and pricing strategies.

🏭 Impact on Manufacturing & Production

- Relocation of Factories: Many companies are moving production from high-tariff countries (like China) to tariff-friendly nations such as Vietnam, India, and Mexico.

- Rising Production Costs: Increased import duties on raw materials and components raise costs for manufacturers, often passed to consumers.

- Strategic Sourcing: Firms diversify suppliers to minimize risk, resulting in more complex but resilient supply chains.

🚢 Logistics & Trade Routes

- Companies are exploring alternative shipping routes to avoid tariff-heavy ports.

- There is a growing reliance on regional trade agreements to circumvent high tariffs, such as RCEP (Regional Comprehensive Economic Partnership) and USMCA (United States-Mexico-Canada Agreement).

- Freight costs and transit times may increase, affecting delivery schedules and inventory planning.

17. Economic Winners and Losers in 2025

While tariffs aim to protect domestic industries, the consequences vary across countries and sectors:

🔹 Potential Winners

- Emerging Markets: Countries like India, Vietnam, and Bangladesh gain a competitive advantage as companies relocate factories to avoid U.S. or China tariffs.

- Domestic Producers in Tariff-Imposing Countries: U.S. steel, aluminum, and semiconductor manufacturers benefit from reduced competition.

- Regional Trade Blocs: Nations in trade agreements with tariff-exempt status see increased export opportunities.

🔹 Potential Losers

- Global Consumers: Prices of imported goods rise, reducing purchasing power.

- Multinational Corporations: Companies with global supply chains face increased compliance costs and operational uncertainty.

- Export-Dependent Economies: Countries heavily reliant on U.S. and Chinese markets may see a drop in exports.

Political Implications of Tariffs

Tariffs are as much a political tool as an economic one:

- Geopolitical Leverage: Countries use tariffs to influence foreign policy and secure trade concessions.

- Domestic Political Pressure: Politicians often impose tariffs to protect local jobs, appealing to voters in key industries.

- Global Diplomacy: Tariff disputes can escalate into diplomatic negotiations, WTO filings, and trade wars that affect international relations.

Example: U.S.-China tariff negotiations in 2025 have prompted multiple rounds of diplomatic meetings, affecting technology, energy, and agricultural trade.

Strategies for Businesses to Navigate Tariffs

Businesses affected by tariffs can adopt several strategies to remain competitive:

- Diversify Supply Chains: Source raw materials and components from multiple countries.

- Localize Production: Move manufacturing closer to consumer markets to reduce import tariffs.

- Reevaluate Product Pricing: Adjust pricing strategies without losing market share.

- Leverage Free Trade Agreements (FTAs): Utilize tariff exemptions and regional trade deals.

- Invest in Automation & Efficiency: Offset increased costs through productivity gains.

- Monitor Regulatory Changes: Stay updated on tariffs, de minimis thresholds, and trade negotiations.

Future Outlook of Global Tariffs

Trade policies are evolving rapidly, and businesses, investors, and governments must anticipate changes:

- AI & Data Analytics: Predicting tariff impacts and optimizing supply chains using AI-powered tools.

- Regional Trade Shifts: Countries outside traditional trade wars could benefit from redirected exports.

- Tariff-Free Zones: Governments may create special economic zones to attract investment while bypassing tariffs.

- Sustainability Considerations: Environmental tariffs may rise, linking trade to climate policies.

Conclusion: Tariffs are no longer just taxes they shape economies, industries, and global geopolitics. Companies that adapt quickly and leverage trade strategies will thrive in this evolving landscape.

Product Categories Affected

- Apparel and Footwear: Countries like Vietnam, Bangladesh, and Cambodia face high tariffs, impacting clothing and shoe prices.CBS News

- Electronics and Semiconductors: Tariffs on Taiwan, South Korea, and Japan affect consumer electronics and components.

- Automobiles and Parts: Higher tariffs on Japan and South Korea impact vehicle imports.Wikipedia

- Agricultural Products: Tariffs on countries like South Africa and Thailand affect fruit, nuts, and other imports.

- Pharmaceuticals and Chemicals: Switzerland and India face tariffs affecting drug and chemical imports.

🔍 Additional Measures

- De Minimis Threshold Elimination: The $800 duty-free import threshold for China was removed effective May 2, 2025, with plans to extend this to other countries, increasing costs for direct-to-consumer imports.Wikipedia